Lorne Kashin’s father made a prediction when the family opened The Eyeglass Factory, an optical store in Thornhill, ON in 1977: “If you get the child, you will get the family.”

“He was right,” says Lorne, who doubles as executive director of the Ontario Opticians Association. “The children’s part of our business has grown significantly over the years and I’m now fitting the babies of babies I fitted years ago.”

Kashin’s experience illustrates the potential of having a child-friendly practice: done right, selling kids’ eyewear is an opportunity to win customers — and their family members — for life.

Still, doing it right involves challenges, starting with the fact that you’re dealing with two customers: the child and her parent. Both are important and their priorities sometimes conflict.

“Kids, especially younger ones, want colour and lots of it, as well as style,” says Sheena Taff, manager of Vancouver-based Roberts & Brown Opticians. “Parents want durability and functionality. You have to find a way to satisfy both.”

Fortunately, says Taff, many of today’s options are stylish and durable. “We offer over 300 frames in many styles and colours so there’s something for almost every child to get excited about.”

Perhaps the biggest challenge is dealing with parents who have strong, preconceived ideas of what they want. “Kids tend to have a higher plus power and that’s not always conducive to the look parents have in mind.”

There may also be conflicts about style: a parent might want thick, bold, black frames, while their child prefers something more conservative, Taff notes.

“A child’s glasses should showcase their style and suit their personality. Otherwise, they’ll wind up broken or at the bottom of the toy box. I encourage parents to let their children make the final decision, provided the visual aesthetics and technical insertion of the lens aren’t a problem.”

She also stresses the importance of fit. “I sometimes see kids wearing glasses that are too big — perhaps the parent is hoping they will grow into them. Remember that your customers are walking ads for you and your reputation rides on fitting them correctly.”

At the same time, says Kashin, it’s important to be responsive to parents’ concerns.

“Make sure they feel you’re paying attention to them. Respect their budget. And if you disagree with their choice, gently steer them toward a better fit and style.”

Despite the challenges, working with children can be tremendously rewarding, he says.

“It makes me feel good because I love kids. There’s something special in each child I meet, so I find that and focus on it.”

Here’s Looking at You, Kids!

There has never been a better time to sell kids’ eyewear. Children’s glasses today are colourful, fun and affordable, featuring fashion-forward styling and revolutionary technical features that ensure a great fit, durability and ease of wear.

Here’s a look at what’s available from some of the top children’s eyewear manufacturers for 2018.

Alternative Eyewear and Plan B Eyewear

The Quintessential Nano Vista collection from Alternative Eyewear and Plan B Eyewear offers a host of revolutionary features, including the patented ‘52’ hinge that allows temples to bend and rotate 360 degrees without breakage or wearing down.

Made with thermo-adjustable, patented SiliflexTM material, each frame in the collection includes a mini temple tip strap to keep the frames secure and comfortable, and a full headband strap that is ideal when worn under helmets for aggressive sports such as hockey, motocross and skiing.

Excellent for special needs children, Nano Vista glasses are available with metal core temples for incredible adjustability, and without the metal core for compulsive children who might chew the frames and hurt themselves on metal parts.

Available in a wide variety of colours, shapes and sizes, these frames are also lightweight and easy to modify. Glow-in-the-dark colours help children to be seen and to find their glasses in the dark. Alternative Eyewear is also launching a magnetic clip-on version that features polarized blue-blocking lenses.

All Nano Vista children’s eyewear comes with an unconditional three-year warranty.

JF Rey

World-famous designer JF Rey has revolutionized the technical aspect of children’s eyewear with JUST ADJUST a patented temple design that enables eyecare professionals (ECPs) to quickly adjust the frame’s temple length to suit the changing physiognomy of the child.

Another special feature of JF Rey Kids & Teens glasses is their special flex hinge, which ECPs can easily change in-store. It was developed to prevent temples from becoming deformed and to ensure the frame’s robustness.

The JF Rey Kids & Teens collection uses beautiful acetates and acetate/stainless steel combos in a variety of shapes, featuring tints and graded colours, and original designs that highlight tortoise shells, stripes, spots and checks. There is something here to appeal to every taste.

All of the collection’s frames come with a two-year warranty.

Lafont

Dynamic new colours and patterns for youngsters aged 4-7 highlight the fall/winter 2018 collection from Lafont pour les enfants.

The style is playful and colourful, with orange, red and blue car patterns driving happily across frames designed for young boys, while purple hearts and delicate plaid patterns adorn frames for young girls.

Lafont is known for children’s eyewear designs that cater to their specific tastes and physical features. The company pays great attention to detail, bridge fit and lens area to ensure a proper fit.

The collection features frame fronts designed from cellulose acetate and temples reinforced with redesigned stainless steel spring hinges to ensure comfort and flexibility.

With adjustable arms, these frames adapt perfectly to the morphology of young children. Soft, modified rectangles with high lens areas and adjustable temple lengths provide a customizable fit. And the exclusive flex system allows kids to practice putting on the eyewear themselves.

All Lafont pour les enfants frames feature a one-year warranty against manufacturer’s defects.

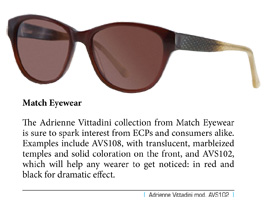

Match Eyewear

Kids can express their own unique personalities with the Float Kids collection from Match Eyewear. Bringing fresh, fun styling to grown-up designs that allow kids to emulate their parents and older siblings, Float Kids Eyewear is a trendy and colourful collection for youngsters aged 4-16.

Sturdy and durable to keep up with a child’s active lifestyle, Float Kids glasses are carefully crafted from premium quality materials and components, ensuring maximum comfort, safety and durability for cool, active kids.

Girls’ styles feature soft, feminine squares made of blue, brown or purple acetate, with solid colour fronts and matching leopard colour temples. Masculine square shapes are available for boys in black, green and grey acetate with solid fronts and multi-stripe temples. All styles feature spring hinge temples for a comfortable fit.

All Float Kids glasses come with a one-year warranty.

OPAL

Young adventurers keen to “master the force” will love the STAR WARSTM collection from OPAL Canada. The collection incorporates the famous expressions, charismatic characters and galactic scenery from the iconic films.

With some models featuring exclusive acetates, these STAR WARSTM frames deliver outstanding quality, which is evident in both their finish and original details. The collection is fun as well as technically advanced, specially designed for aspiring young Jedi. And each frame comes with a case and a branded gift.

OPAL offers Canadian kids several other cool collections to choose from, including the Disney collection for children ages 3-8: boys can choose from Avengers and Spiderman, while girls can select the Frozen or Disney Princess collections.

The Little ELEVENPARIS collection is designed for those ages 8-14, and ELEVENPARIS is created for those 14 and older.

All OPAL Canada glasses for children come with a two-year warranty.

Sàfilo

Introducing playful new colours and comfort features, the all-new 2018 Kids by Sàfilo ophthalmic collection features fun and original graphics on styles dedicated to children 3 to 8 years of age.

New elastic straps and ultra-soft silicone tips help to keep the frames in place without compromising comfort, even for extended periods of wear.

Exclusive new clip-on sun-covers with polarized lenses are also available for children ages 3-8, for glare-free vision, clear contrasts, vision of natural colours, reduced eye fatigue and 100 per cent UV protection.

“100 per cent Made in Italy”, the KIDS BY SÀFILO optical collection is made of light, safe, bio-based materials and includes designs for children from infants to 8-year-olds. Soft rubber is moulded over the internal temple and bridge, while high-performance polymers are used for the front and temples. These biocompatible, hypoallergenic, non-toxic and washable materials guarantee safety.

KIDS BY SÀFILO frames are lightweight and stable, thanks to a lower bridge and the temple design, which features a horizontal bend. The enhanced design of the front ensures that the lenses cover the children’s entire field of vision, guaranteeing effective correction.

Every KIDS BY SÀFILO frame comes with a two-year warranty against manufacturer’s defects.

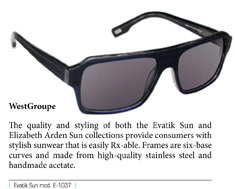

WestGroupe

WestGroupe presents 16 new styles from its Superflex Kids (SFK) Back to School (BTS) 2018 Collection.

The SFK BTS 2018 collection is far-reaching with both metal and acetate styles capturing all the latest eyewear trends. For girls, acetate is fun and funky with confetti glitter and sparkly plaids, while sporty colours are centre stage for boys. With its mission of making eyewear fun for kids, the new models are available in a wide range of hues from colour that pops to clean neutrals. Colour blocking, a key fashion trend this season, is highlighted throughout the collection.

Two-tone colouring on the metal styles is enhanced with etched patterns ranging from racing stripes to baroque florals, giving the temples a textured feel and 3D effect. In acetate, triple laminations provide a more classic take on the trend, as does the blocked effect of patterned tortoise temples coupled with tonal colour fronts. The collection is well balanced between boys, girls and unisex styles in trending shapes of rectangles, squares and rounds to fit every kid’s personality.

All SFK models have a spring hinge for added durability and comfort and come with a two-year warranty against manufacturer’s defect.

By JoAnne Sommers

IRIS recently implemented customer surveys to assess the likelihood that a customer will recommend IRIS. Customers are encouraged to fill out the survey at the point of sale, and are also selected randomly and approached by email.

IRIS recently implemented customer surveys to assess the likelihood that a customer will recommend IRIS. Customers are encouraged to fill out the survey at the point of sale, and are also selected randomly and approached by email.

Integration is not necessarily apparent to the consumer, but the fact that Luxottica owns

Integration is not necessarily apparent to the consumer, but the fact that Luxottica owns

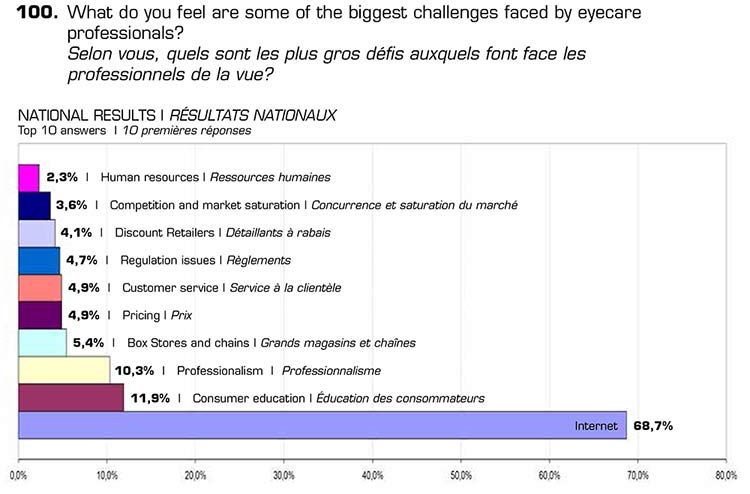

At the same time, the Internet was the most popular choice among those who specified where they think future opportunities in the industry will arise.

At the same time, the Internet was the most popular choice among those who specified where they think future opportunities in the industry will arise.